Just before sharing my J.O.S.H framework, here’s what my clients have to say about working with me:

How A 26 Years Old Sole Breadwinner Secured His Family Well-being In The Event He Is Unable To Work Anymore.

Meet Hafizul

Hafizul and I have been friends since secondary school. He's currently working as a technician in SCDF, and is the sole breadwinner in his family.

We decided to catch up with each other over a meal and chatted about adulting. He wanted to find out more about his finances and decided to set up another appointment with me just to talk about financial planning.

Before we met, Hafizul already knew the importance of insurance. However, he was overwhelmed by the sheer amount of products out there, and was completely clueless on how to go about starting his financial planning journey.

He was also worried about his BMI being an obstacle to getting insured and needed advice on how to go about it.

After simplifying for him the various types of financial instruments, he gained much clarity and knew exactly what he needed given his current situation.

With a customized solution, he feels reassured him that his family's well-being is secured. On top of that, he is glad that the flexible wealth accumulation strategy that I proposed brought him one step closer to retirement.

Hafizul was thankful to have met me as he now has a peace of mind and no longer has to worry about getting into a mishap which would previously affect not just his livelihood, but his entire family as well.

How I Helped A 25 Year Old Lab Technician Take Ownership Of His Policies And Save Up To $100k In Premiums!

Meet Rio

Rio is my poly mate and is currently working in A*Star. After coming to know that I was a financial advisor, he wanted me to review his current policies.

Before meeting me, Rio's mother wanted him to takeover his own policy. However, he is completely clueless about whether his smoking habits would affect his policy as he has never met the family agent before. To make matters worse, he wanted to keep smoking a secret from his mother, who was strongly against him switching his policy. As a result, he felt extremely frustrated and didn't know what to do.

After consulting me, he understood both the benefits and limitations that his existing policies have for him. I also noticed that he was in fact overpaying for his policies for minimal coverage and drafted an alternative strategy for him. This helped him save on premiums up to $100k without compromising on his existing coverage!

I also worked closely with Rio and his mother and addressed her concerns before proceeding to switch his policies after getting the green light.

Rio is extremely pleased as he now has complete ownership over his own financial planning. The cost savings has also brought him one step closer to financial freedom!

How I Help A Fresh Graduate IT Professional Kickstart His Passive Income Of $5,685/year

Meet Kenneth

I met Kenneth during his graduation in NTU when I was visiting a friend of mine who is also graduating. After a casual conversation about financial planning, we exchanged numbers. When we met up for an appointment, he only had an old life plan and a hospital plan without a rider. He also had little to no wealth accumulation tools in place to help him achieve his retirement dreams.

Kenneth wanted to get additional coverage but he was concerned about his “high cholesterol” condition, and didn’t know if it would affect his planning. The hospital rider lapsed because his agent was too busy to meet him. Also he wanted to start building his passive income but was clueless where to begin.

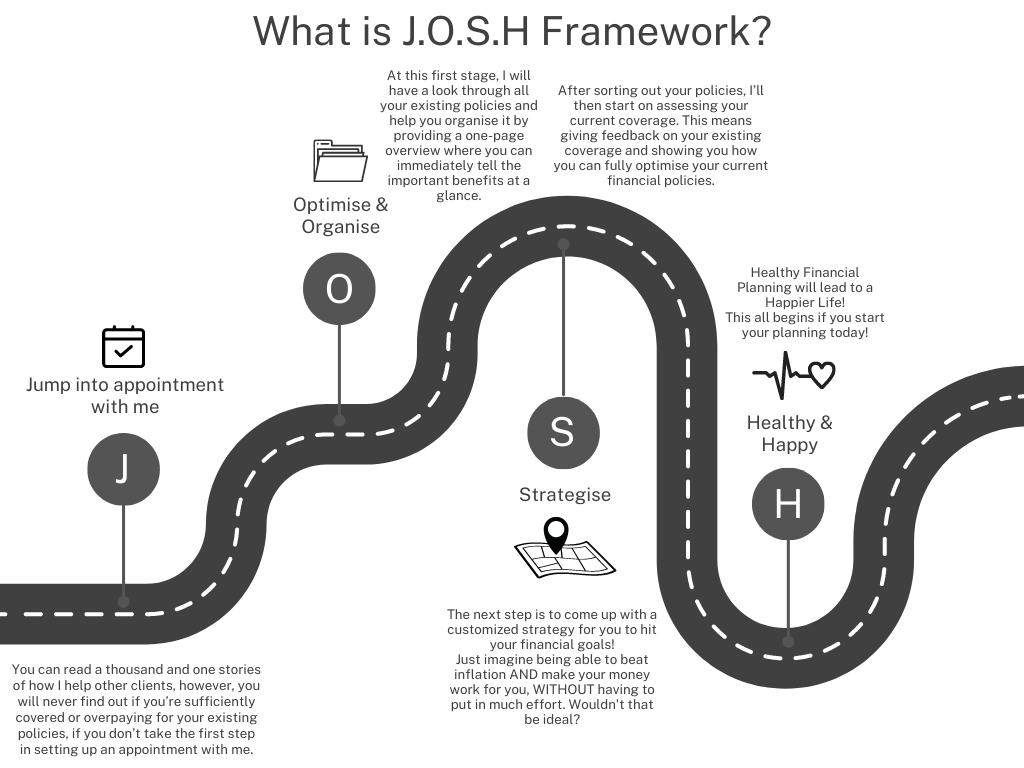

First we went through a presentation to share with Kenneth what are the types of insurance there is and why need it in the first place. Secondly, we went through the J.O.S.H framework, to help him organise and strategise his current portfolio. The entire experience was very productive and he is glad that I managed to clear all his burning doubts he had beforehand.

Kenneth has since come to realise the importance of future-proofing his financial portfolio. He is super excited to work with me to help him grow his wealth. He felt assured knowing that he is sufficiently covered. Now he is proud to be one step ahead of his peers on reaching financial independence and retiring early

Don't just hear it from me

Here are some more of the testimonials given to me

Want To Find Out More?

Frequently Asked Questions

Do I need to have prior financial planning knowledge before I get on this session?

Why work with you?

What is the risk on my side?

Do I need to dig out my old policy document before I meet you?

Would you hard sell me when we go on an appointment?

You look so young, what makes you think you can do a better job than me?

Find out on how you can live your life to the fullest!

Simply fill out the form below click on the link below and I'll contact you personally, within 24 hours.